Resale and auction activity was mixed in January 2021. Overall, average FLVs and FMVs were relatively flat on a month-over-month and year-over-year basis.

March 8, 2021

Construction activity in January 2021 was down on the resale channel, continuing a gradual decline in activity that we have observed since the elevated levels starting in March 2020. That overall trend paired with a seasonal trend we often see where listings on the resale channel contract a bit from December to January, resulted in the 13.8% month-over-month decline we observed for January.

As expected, activity on the auction channel was down 52.1% month-over-month. January 2021 auction activity, however, was up compared to both January 2020 and January 2019. Looking ahead, we typically see high auction activity in February and given the success auction houses have had pivoting to online events we do not anticipate that to be a particular hinderance this year. Be sure to check back next month for a closer look at overall auction results and analysis.

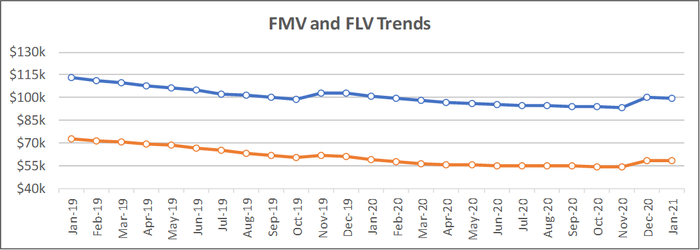

Overall, average FLVs and FMVs* were relatively flat on a month-over-month and year-over-year basis but were down compared to the same period two years ago.

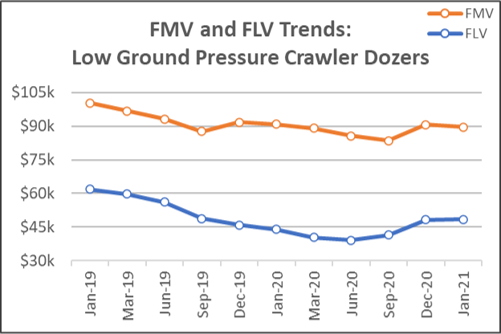

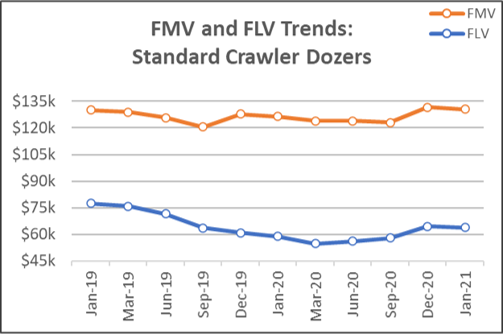

When reviewing value trends at an equipment type level, Low Ground Pressure (LGP) Crawler Dozers and Standard Crawler Dozers stood out, so we will be highlighting them here. As we can see, LGP Crawler Dozers have followed a similar values trend as the construction segment overall. Standard Crawler Dozers, on the other hand, have enjoyed much steadier FMVs. Average FMV for LGP Crawler Dozers was flat on both a month-over-month and year-over-year basis, but down 10.7% compared to where it stood two years prior. Average FLV was also flat month-over-month, and down compared to two years ago (21.8%) but was up 10% on a year-over-year basis.

Average FLVs for Standard Crawler Dozers essentially mirrored what we saw for LGP Crawler Dozers. On the resale channel, though, FMV was about the same in January 2021 as it was in January 2019.

For the construction segment overall, on the resale channel, average age was up 15.9% month-over-month but was relatively flat compared to the previous two years. The month-over-month increase is mostly accounted for by the change of the year from 2020 to 2021, thus making everything a bit older in our calculations. Beyond that, while we have begun to see some activity shift to newer model years, it has not yet shifted enough to balance out the average age. In fact, in December 2020 we observed that 83.4% of the construction market data was comprised of model years 2010 or newer, but that dipped a bit in January 2021 to 80.8%, helping inflate the average age. Over on the auction channel average age was up 10.0% year-over-year but was flat month-over-month and compared to the average two years ago.

Average utilization was down month-over-month on both the resale and auction channels. On the auction channel, average utilization was up compared to the previous two years, while on the resale channel it was relatively flat compared to both January 2020 and January 2019.

*Fair Market Value (FMV) is the value of an asset sold to a single buyer under no compulsion. Forced Liquidation Value (FLV) is the value of an asset sold at a properly advertised and conducted auction in which the seller is under compulsion to sell on an as-is, where-is basis as of a specific date.

This article is brought to you through a collaboration between EquipmentWatch and World of Concrete 360. Don’t miss the presentation, Making Advanced Decisions About Your Equipment, with Tom Christerson, director of sales for EquipmentWatch, that was held during the WOC 360 Virtual Industry Forum. The EquipmentWatch Market Report is a monthly resource for the construction, lift/access, and agriculture industries to help equipment managers make better-informed decisions by leveraging key equipment values, market activity, age, and usage metrics. For more information about EquipmentWatch’s methodology and data, and to learn more about what it has to offer contractors, click here.

About the Author(s)

You May Also Like