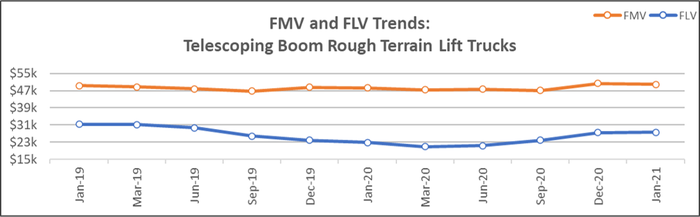

Activity on the resale channel for telescoping-boom rough-terrain lift trucks is 85% higher in January 2021 than January 2019.

March 21, 2021

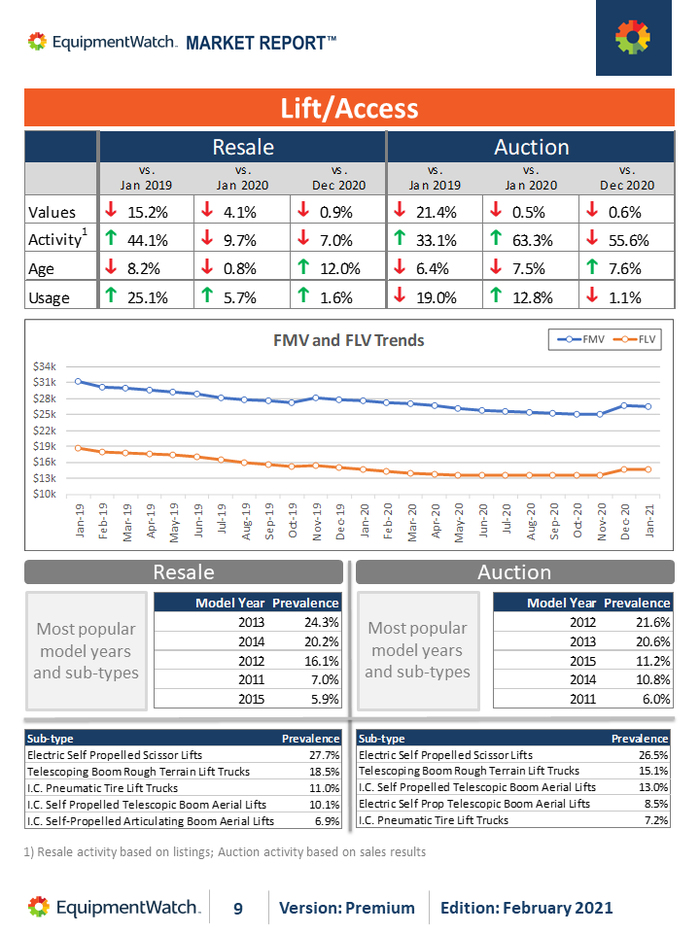

Overall, average values for the lift/access segment of the equipment market were relatively flat on both the resale and auction channels on a month-over-month basis in January but were down compared to the same period two years ago. Average FLV was also flat year-over-year, but average FMV was down 4.1% year-over-year.*

Activity on the resale channel was down a bit month-over-month and year-over-year, but still up 44.1% compared to January 2019. On the auction channel, activity was predictably down month-over-month, but up significantly both year-over-year (up 63.3%) and compared to two years ago (up 33.1%).

We have observed increased activity on the resale channel for telescoping boom rough terrain lift trucks over the past two years, with activity in January 2021 85% higher than January 2019. This is also the second-most prevalent type of equipment we see on both the resale and auction channels. Given this growth and popularity, we wanted to highlight its average values over the past two years.

As we can see, average values for telescoping-boom rough-terrain lift trucks have fared better than the lift/access segment as a whole. Average FLV was down 12.2% compared to two years prior but has rebounded 20.3% compared to January 2020. On the resale channel average FMV was 1.1% higher in January 2021 than where it stood in January 2019.

For the lift/access segment overall, average age was down compared to last year and the year before on both the resale and auction channels but was up a bit month-over-month on both channels.

Average utilization was up month-over-month and compared to the previous two years, with average utilization 25.1% higher on the resale channel in January 2021 compared to where it was in January 2019. On the auction channel, however, average utilization was down 19.0% compared to two years ago, up 12.8% year-over-year, and relatively flat month-over-month.

*Fair Market Value (FMV) is the value of an asset sold to a single buyer under no compulsion. Forced Liquidation Value (FLV) is the value of an asset sold at a properly advertised and conducted auction in which the seller is under compulsion to sell on an as-is, where-is basis as of a specific date.

This article is brought to you through a collaboration between EquipmentWatch and World of Concrete 360. The EquipmentWatch Market Report is a monthly resource for the construction, lift/access, and agriculture industries to help equipment managers make better-informed decisions by leveraging key equipment values, market activity, age, and usage metrics. For more information about EquipmentWatch’s methodology and data, and to learn more about what it has to offer contractors, click here.

About the Author(s)

You May Also Like