With live auctions too risky, overall auction activity was up 14% compared to 2019 although values were down, with crawler mounted compact excavators and four-wheel-drive articulated wheel loaders standing out.

February 8, 2021

According to the Association of National Advertisers, 2020’s word of the year was “pivot.” As the world was thrown into turmoil due to the coronavirus pandemic, everyone needed to pivot but particularly businesses. And in 2020, while adapting meant donning face masks and trying to maintain six feet of physical distance, pivoting typically meant moving online. So how did all this change and pivoting impact the world of auctions?

Of course, online auctions were already very much a thing before 2020, but it was in the spring of 2020 that live auctions became too risky and the online auction was the only way to go. As the summer and fall got on, we heard from auction houses and could begin to see in our data that sales volumes were strong, so now that the books on 2020 have come to a close we wanted to examine this topic in more detail.

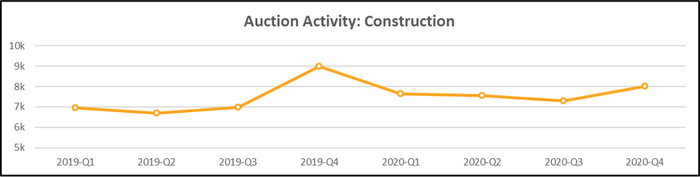

Our research reveals that auction volumes overall for 2020 were 14.1% higher than 2019. Each equipment segment we track (construction, lift/access, and agricultural) all experienced year-over-year volume increases.

Construction auction volume was up 3.0% overall, with the first three quarters of 2020 showing year-over-year increases, while the fourth quarter dipped 10.9% compared with the same period of 2019. The fourth quarter of 2019 had very strong auction volumes compared to the first three quarters of 2019, though, so not reaching those activity levels, especially considering some sector slowdown now being reported due to project delays and cancellations, is perhaps not a surprise.

Among the top 20 most popular types of construction equipment sold at auction, four-wheel-drive articulated wheel loaders saw a decline each quarter and the biggest year-over-year deterioration of 9.7%. On the other end, portable light towers saw year-over-year increases each quarter and the biggest full year-over-year increase of 46.5%. The spike in activity for portable light towers in particular seems interesting given reports that many infrastructure projects that would have typically been relegated to overnight hours, when ample lighting would be imperative, were reported to be shifting more to the daytime.

Values

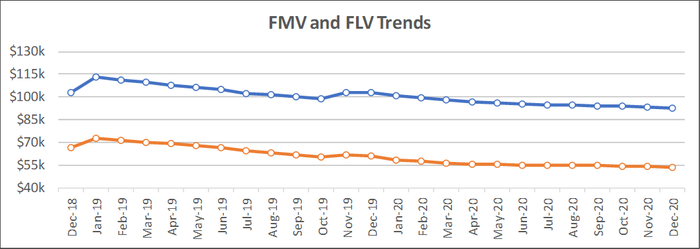

For construction equipment overall, average fair-market value (FMV) and forced-liquidation value (FLV)* declined month-over-month, year-over-year, and compared to the same period two years ago. The month-over-month declines were relatively small with FMV down 0.5% and FLV down 0.7%. Comparisons to both 2019 and 2018 were more substantial and ranged from minus 9.6% to minus 19.5%.

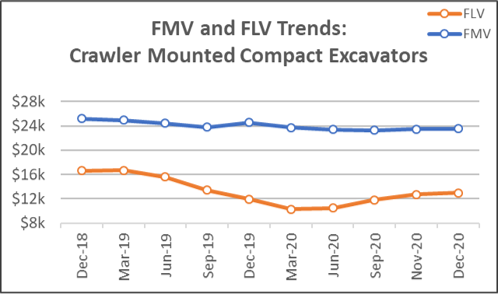

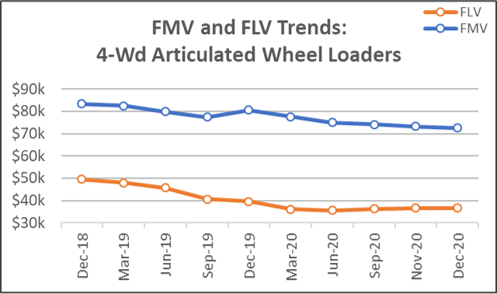

Two specific types of equipment stood out when analyzing the changes in average FLV and FMV: crawler mounted compact excavators and four-wheel-drive articulated wheel loaders.

The first, crawler mounted compact excavators, stood out because its average FLV and FMV both increased in December 2020 when compared to the previous month (2.3% FLV, 0.3% FMV). While FMVs were down compared to the previous two years and FLV was down 21.7% compared to 2018, FLVs were up 8.9% year-over-year. The more recent relative strength could be due to this equipment type’s versatility and usefulness in our current environment.

While crawler mounted compact excavators have many applications, they are particularly popular for smaller projects and the increase in values could be thanks to how well the residential building and home maintenance and repairs markets have been faring.

The other equipment type that stood out was four-wheel-drive articulated wheel loaders. Values for this equipment type were basically flat compared to the previous month, but average FLVs fell 26.2% compared to December 2018 and 7.5% compared to December 2019. Average FMVs were even worse and fell 9.8% compared to 2018 and 13.0% compared to 2019. While this type of equipment also has many uses, it is often used for more nonresidential and infrastructure projects, so lower values could be due to project delays and cancellations related to those types of jobs.

Construction Equipment

Overall, resale activity for construction equipment was down in December 2020 compared to the same time last year (12.9%) and the year before (2.1%) while being basically flat compared to November 2020.

Auction activity is more seasonal and more volatile than resale and we could see that in this month’s reporting. December 2020’s auction activity was down 18.9% compared to the same time last year but up 31.1% compared to two years ago and up 87.5% compared to November 2020.

On the resale channel, average age was up slightly in December 2020 compared to the previous month and previous two years, while the inverse was the case on the auction channel.

Average utilization was up almost across the board. The one exception being on the resale channel where average utilization was down 0.6% compared to the previous month.

Looking ahead, we typically see activity dip in January compared to December. With the strength of residential construction, but the project delays being reported in nonresidential and infrastructure construction, we are likely to see uneven changes in valuations depending on an individual equipment’s application.

*Fair Market Value (FMV) is the value of an asset sold to a single buyer under no compulsion. Forced Liquidation Value (FLV) is the value of an asset sold at a properly advertised and conducted auction in which the seller is under compulsion to sell on an as-is, where-is basis as of a specific date.

This article is brought to you through a collaboration between EquipmentWatch and World of Concrete 360. Don’t miss the presentation, Making Advanced Decisions About Your Equipment, with Tom Christerson, director of sales for EquipmentWatch, that was held during the WOC 360 Virtual Industry Forum. The EquipmentWatch Market Report is a monthly resource for the construction, lift/access, and agriculture industries to help equipment managers make better-informed decisions by leveraging key equipment values, market activity, age, and usage metrics. For more information about EquipmentWatch’s methodology and data, and to learn more about what it has to offer contractors, click here.

About the Author(s)

You May Also Like