Construction Equipment Activity Among the Top 10 OEMs

A look at construction equipment resale and auction values in September. Plus: How are the top original equipment manufacturers (OEMs) faring?

November 5, 2021

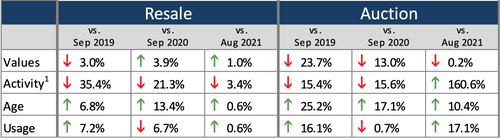

As has been the case for several months with construction equipment, activity for September 2021 was generally down and average age was up. One exception in this month’s report is that auction activity was up 160.6% compared to August. Auction activity is highly seasonal, and September is typically a higher volume month than August, so no big surprises there.

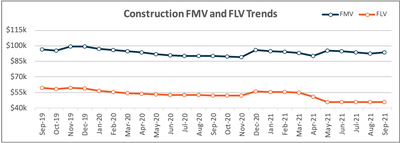

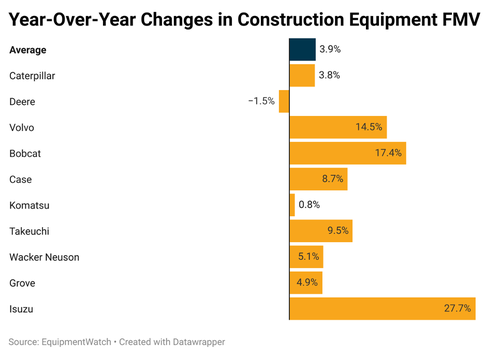

FMVs were up 3.9% year-over-year while FLVs were still down 13.0% compared to one year prior. We continue to see lack of new equipment driving down used equipment activity while also driving up average age and muting overall average values.

(Resale activity based on listings; Auction activity based on sales results.)

While we often will dive into a particular category or type of construction equipment to dig into these overall trends, this month we wanted to take a look at how specific original equipment manufacturers (OEMs) are faring.

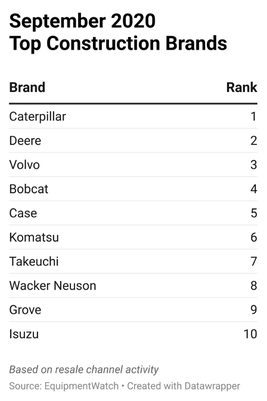

The top 10 construction equipment brands from September 2020, according to activity on the resale channel, are listed in the table below. These ten brands made up about 75% of all resale construction activity in September 2020.

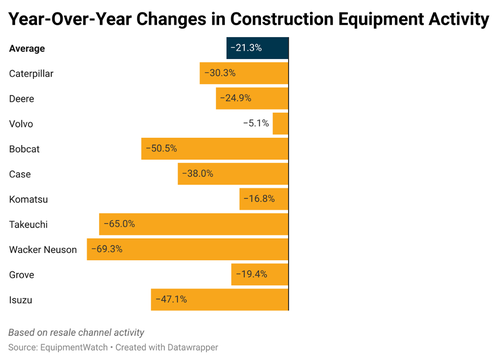

Between September 2020 and September 2021, we saw that overall resale construction activity fell by 21.3%. Breaking these changes out by brand, we can see that Wacker Neuson and Takeuchi had the steepest declines in resale activity, both falling by 65.0% or more. On the other end of the spectrum, Volvo had the lowest decline at just 5.1%.

This disparity could be at least partially explained by the fact that Volvo’s activity was already suffering in 2020, having declined 4.2% since September 2019. The same was true for most of the other brands on this list, with the exceptions of Grove, Wacker Neuson, and Takeuchi. These three brands all saw increases in activity between 2019 and 2020.

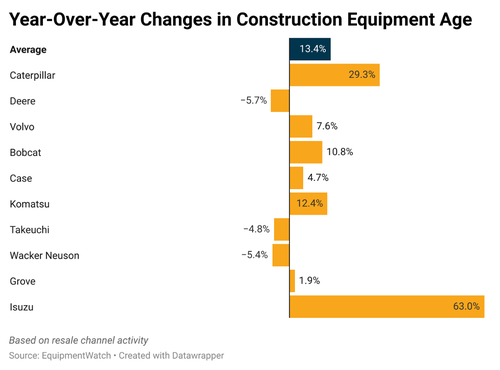

Looking at average age, seven of the 10 brands saw year-over-year increases for resale construction equipment. Isuzu saw the biggest jump in average age, increasing 63.0%, likely thanks to having such a relatively low average age in September 2020 (about 4.7 years). As we have been seeing throughout 2021, average age has been increasing steadily as OEMs struggle to get new equipment to customers and those fleet owners often have to delay selling their existing equipment while they wait.

Last but not least, our review of average FMV for construction equipment showed that only one OEM saw a year-over-year decrease. Deere’s 1.5% decrease in average resale values was mostly due to decreases it saw for some of its larger wheel loaders and excavators and throughout the category of forestry equipment. Besides Deere, we can see that seven of the ten brands beat the average of 3.9%, showing some impressive year-over-year FMV increases.

*Fair Market Value (FMV) is the value of an asset sold to a single buyer under no compulsion. Forced Liquidation Value (FLV) is the value of an asset sold at a properly advertised and conducted auction in which the seller is under compulsion to sell on an as-is, where-is basis as of a specific date.

This article is brought to you through a collaboration between EquipmentWatch and World of Concrete 360. The EquipmentWatch Market Report is a monthly resource for the construction, lift/access, and agriculture industries to help equipment managers make better-informed decisions by leveraging key equipment values, market activity, age, and usage metrics. For more information about EquipmentWatch’s methodology and data, and to learn more about what it has to offer contractors, click here.

About the Author(s)

You May Also Like