How are disruptions impacting the brands available on the resale channel? Equipment Watch offers an analysis of resale listings and prevalence by brand.

September 10, 2021

Equipment Watch

Over the past few months, we have been discussing in this report how resale activity has been depressed as new equipment production and delivery have been delayed. If equipment owners can’t be confident they are going to be able to get replacement equipment in a timely manner, then they are going to be hesitant to follow their normal disposition schedule. The data for this month tell a similar story, with resale activity for construction, lift, and agricultural equipment all down again on a year-over-year basis. June 2021 construction equipment resale activity, for example, was down more than 25% compared to June 2020.

This month we are going to look at how these disruptions are impacting the brands available on the resale channel. We have looked back at resale data from June 2019 and June 2020 to compare to June 2021 and see how the composition has shifted. We are breaking the analysis down within the categories of construction, lift, and agricultural equipment by diving into a specific popular equipment type for each.

Construction

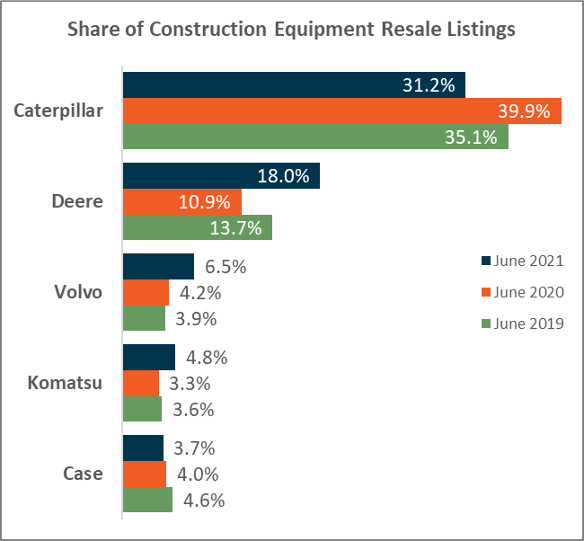

There are a few standout numbers from the construction equipment breakout. First is that despite a slide in resale listings compared to both June 2019 and June 2020, Caterpillar is still by far the most prevalent equipment brand with 31.2% of resale listings in June 2021. That is down from 39.9% in June 2020 and 35.1% in 2019, but still represents almost a third of the equipment observed on the resale channel.

Picking up some of that reduced share of listings are Deere and Volvo. Deere branded equipment made up 18.0% of the resale listings in June 2021, up from 10.9% in June 2020 and 13.7% in June 2019. Likewise, Volvo has seen its share of resale market activity nudge up over the previous two years reaching 6.5% of listings in June 2021.

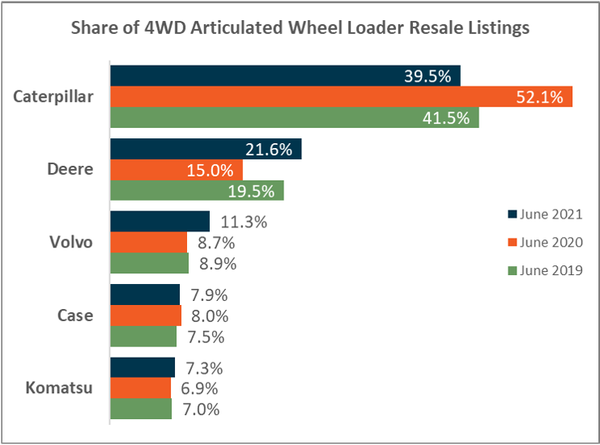

Digging into one particular type of construction equipment, we analyzed the resale activity specifically for 4-wheel drive articulated wheel loaders. It is interesting to note that the top five brands are precisely the same as for the construction equipment category overall, although Case and Komatsu switch places for the number four and number five spots. Besides just the order, the data trends themselves are also very similar, with Caterpillar as the dominate brand but Deere and Volvo picking up a bit of market share.

One likely explanation for why Caterpillar has seen its share of the resale listings decline is that it is a highly valued brand and equipment owners are not going to want to let go of their Caterpillar equipment if they’ve got additional projects on the horizon and are unsure of when they will be able to replace. Between shipping delays1 and semiconductor shortages2, the concern over delivery of new equipment is valid and something Caterpillar itself has acknowledged.

Articles Referenced:

1. Machinery manufacturer Caterpillar is expecting shipment delays due to the Suez Canal gridlock. Retrieved July 21, 2021.

2. Caterpillar flags supply-chain risks as global recovery boosts earnings. Retrieved July 21, 2021.

This article is brought to you through a collaboration between EquipmentWatch and World of Concrete 360. The EquipmentWatch Market Report is a monthly resource for the construction, lift/access, and agriculture industries to help equipment managers make better-informed decisions by leveraging key equipment values, market activity, age, and usage metrics. For more information about EquipmentWatch’s methodology and data, and to learn more about what it has to offer contractors, click here.

You May Also Like