Use this data—presented monthly by the Farnsworth Group and the Home Improvement Research Institute—to bolster your roofing and exteriors business against some of the industry's biggest challenges.

Each month, the Farnsworth Group and the Home Improvement Research Institute (HIRI) release updates to the PRO Home Improvement Monthly Tracker, which examines several key factors that impact customer behaviors and attitudes in the home improvement industries. They collect data via monthly surveys distributed to contractors and do-it-yourself/do-it-for-me enthusiasts, providing a consistent pulse on each audience's projects, thoughts and behaviors.

Here are four key highlights from May's contractor-specific report:

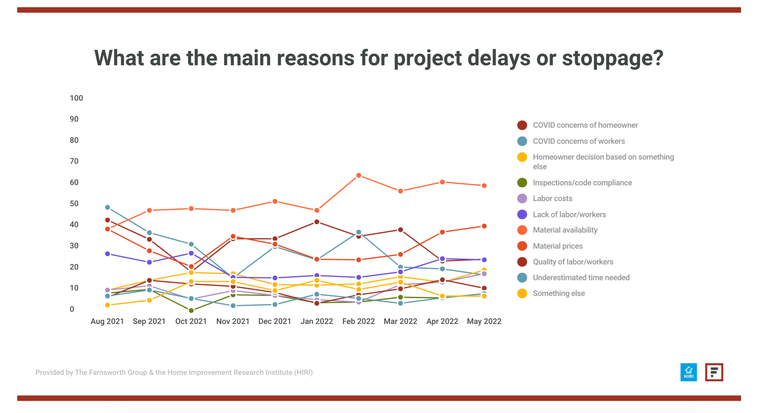

1. Fewer Project Delays, but Same Problems Persist

April and May pointed to fewer project delays among pros. Availability remained the top cause, but material pricing moved up the list. COVID concerns among workers and homeowners have both fluctuated since August 2021, likely in response to case numbers and information in the news.

2. Labor Challenges Ramp Up as Busy Season Hits

This is not a new issue for the home improvement industries, but that doesn't make it less difficult to combat. In May, those surveyed reported more difficulty finding framers and plumbers and less difficulty finding builders and remodelers/general contractors compared to April's data.

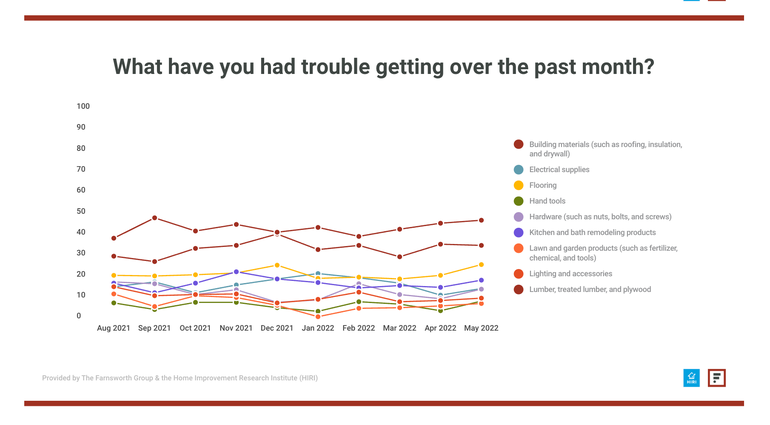

3. Lumber and Building Materials Pose Biggest Availability Issues

As they have since August 2021, contractors again reported lumber and building materials (such as roofing, insulation and drywall) as those they had the most trouble accessing over the last month. The current delays for materials continue to sit steadily at around two weeks for most pros.

4. More Than 60% of Pros Report Low to Moderate Cost Challenges

To mitigate these challenges, nearly 30% of those surveyed said they either purchased a cheaper brand or product or purchased less of a product than they had planned. Farnsworth and HIRI only recently began tracking cost and pricing data, so it will be interesting and informative to see more data accumulate in the coming months.

For a more detailed look at the May data and numbers from previous months, visit www.thefarnsworthgroup.com.

Read more about:

material shortagesAbout the Author(s)

You May Also Like