Some day you will leave your company. Start developing well in advance a comprehensive plan that includes succession of leadership, management and ownership.

Each week, sometimes multiple times per week, we get inquiries about business succession plans from contractors throughout the U.S. and Canada: “What do I do? How do I do it? When should I start?”

When you read about succession in the financial press or industry trade publications, much of the time you're reading about ownership succession—how to transition the ownership of a company from one generation of leadership to the next.

But there are two additional, perhaps even more important, components to succession. The first is management succession and the second is leadership succession. A succession plan is utterly incomplete unless it addresses all three succession components, and if you figure out management and leadership succession first, ownership succession becomes a much simpler puzzle to solve.

Here’s an example: If a CEO is going to retire, and the COO is going to step into that role, there will be a big hole in the organization until someone new steps into the COO role. Therefore, there must be a management succession plan. These executives will need to adjust the entire management group.

Leadership succession also must be part of the mix. Leading a company successfully often comes down to the way leaders communicate with and inspire their people. But no two people are the same.

Understanding approaches to succession planning

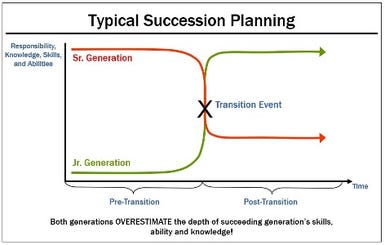

Many contractors view transition as a single event, as illustrated in the first graphic below. The CEO retires, and his successor leaps into the breech. That singular view of the transition puts a tremendous amount of pressure on employees and the organization. Almost inevitably, both the departing leaders and the next generation of leaders overestimate the successors’ capacity for managing and leading the organization.

The capability of the next generation to learn and grow the business diminishes year after year if you fail to address management and leadership succession. It's unfair to your customers, trade partners and employees.

A better way to undertake succession

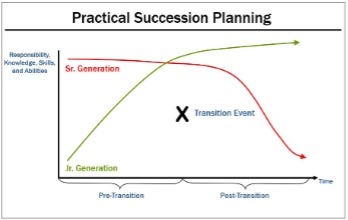

In the second graphic, the axes remain the same. But here, both the senior executives and the successors start leadership and management succession planning well in advance of any departure event. They work together to strategize over a series of open-ended questions:

Who will take on management responsibilities?

Who will hold leadership responsibilities?

Who's responsible for what?

How do we hold each other and our people accountable?

These challenging questions and more require answers well before any planned transition event.

Creating a well-timed succession plan

Do you need six months to transition from one leadership and management team to the next? Do you need a year? The tough reality is that you need seven to 10 years. That period of time is ideal because you're going to stumble. Precious few succession plans go perfectly the first time because we're human beings and incapable of being perfect.

“But Wayne,” you say, “I don't have seven to 10 years! I'm already 72, and I'm worn out. Maybe I'm good for two or three more years.”

If that’s your circumstance, you still must put the work into creating a coherent plan for succession. After all, you wouldn't walk on a jobsite and start moving earth or pouring concrete without having a plan. Succession is, if you think about it, the biggest project of your career. It is the culmination of all the decades of hard work.

Five tips for making succession easier

1. Get your entire leadership team involved

Just like when you do strategic planning, get your business’s best hearts and minds involved with the process. Think through everything, check all the boxes, and eliminate your blind spots.

2. Communicate the succession plan

Your employees are smart enough to know that leadership, management and ownership succession will change things. They want to know that you have a handle on succession so that their careers are secure and that their jobs are more likely to be there five years from now.

Also, make sure to communicate the plans to your bank, bonding company, customers, vendors and trade partners. You will get many, many thanks internally and externally for communicating the plan early and clearly.

3. Allow for changes in style and tone

I recall a father and son who were going through a business transition. In fact, the son had already taken the business to dramatic new heights. Dad was in his 70s; the son was a little under 50. They were discussing upcoming changes and developing a strategy to get the employees on board.

The father was a bit perplexed and started shaking his head: “Why don't you just tell them what to do? Why don't you just make them do it?” The son was very patient, and he said, “Dad, that just doesn't work anymore with today's employees. I could do that, but it wouldn’t be effective.”

For us in the older generations, when we came into the workforce and the boss said, “Jump!,” we said, “How high?” We didn't ask to know what the motivation was, or what the plan was. Today's employees are different. They want to have a stake in the planning and the outcome. They want to know how they will be affected and how they can contribute to a successful succession effort.

4. Get outside, objective input

Get your advisors involved: your lawyer, CPA, financial planner and banker. Even better, involve your peers. Professional advisors are wonderful, but the best business advice comes from like-minded peers. Make sure that you're learning from their successes and, perhaps more important, their mistakes.

5. Start early

Even if you're 60 and still going strong and feeling great, start thinking about your succession strategy. Give yourself seven to 10 years, or as close to that as you can. You might feel very comfortable that things will work out simply because they always have. In that case, the succession plan is not for you—it's for the security and peace of mind of everyone else on your team.

Wayne Rivers is the co-founder and president of the Family Business Institute. He has authored four books about families in business and has appeared on multiple nationally televised programs.

He serves as an expert panelist for The Wall Street Journal and has been quoted by Forbes, Fortune, BusinessWeek, Entrepreneur, CFO, Family Business, The New York Times, The Washington Post and many other trade, local, regional and national publications.

For over 15 years, Rivers has produced a blog and written hundreds of articles for various magazines and trade publications. He has held workshops and lectures for trade associations, prominent companies and well-respected universities. Along with being an Informa Markets Infrastructure & Construction contributor, he has also been honored as a Fellow of the Family Firm Institute.

About the Author(s)

You May Also Like