U.S. Census Bureau Releases July Construction Spending Figures

Private nonresidential construction spending was down 0.2% while public nonresidential construction spending was up 0.6% for July.

Total construction—residential and nonresidential—spending was up 0.3% in July from the previous month's figure, according to U.S. Census Bureau data.

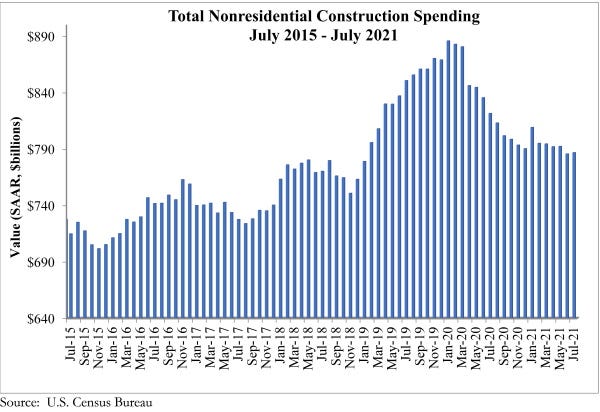

Total construction spending, on a seasonally adjusted annual rate, totaled $1.57 trillion—$786.7 billion in nonresidential construction and $782.1 billion in residential construction—for July.

Total construction spending decreased in several categories including public safety (down 38.5%), lodging (down 30%) and conservation and development (down 21.5%).

Private nonresidential construction spending was down 0.2% while public nonresidential construction spending was up 0.6% for July.

From July 2020 to July 2021, total nonresidential construction spending is down 4.2%.

During the first seven months of this year, construction spending amounted to $883.2 billion, which is 6.2% above the $831.5 billion for the same period in 2020.

Industry response

“The nonresidential construction spending numbers are meaningfully worse than they initially appear,” Associated Builders and Contractors Chief Economist Anirban Basu said. “While the headline number suggests that nonresidential spending was effectively flat in July, the figure does not adjust for inflation. In real terms, the volume of construction services delivered by the nation’s nonresidential contractors declined in July."

Basu cited higher material prices and worsening skills shortages as the "primary culprits."

“Many project owners are delaying projects due to elevated construction service delivery costs," Basu said. "With COVID-19 continuing to wreak havoc on supply chains, materials prices and transportation costs are set to remain elevated well into 2022.

“Data indicate that public construction spending has been more negatively affected than private spending,” Basu continued. “While overall nonresidential construction spending is down 4% on a year-over-year basis, public construction spending is down more than 5%. That said, there are some private segments that continue to exhibit weakness, due in part to behavioral shifts that have transpired during the public health crisis. Spending is down year over year in the lodging and office segments, and neither of these segments exhibited a rebirth of momentum in July.”

About the Author(s)

You May Also Like