Survey: Contractor Confidence Down for 2nd Straight Month

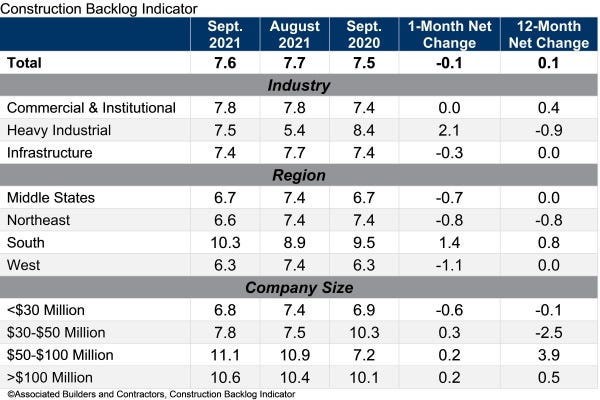

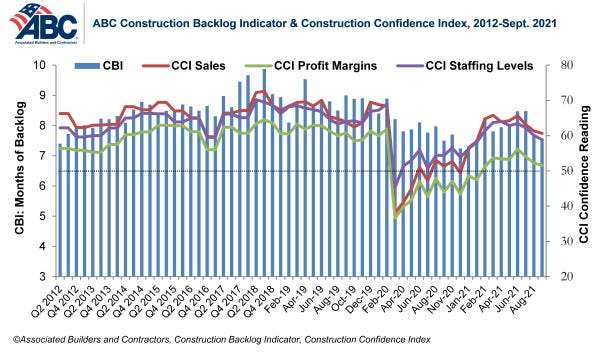

Associated Builders and Contractors reported that its Construction Backlog Indicator fell to 7.6 months in September.

October 12, 2021

Associated Builders and Contractors reported that its Construction Backlog Indicator fell to 7.6 months in September, according to a member survey conducted Sept. 20-Oct. 4.

The reading is down 0.1 months from August 2021, but up 0.1 months from September 2020, per ABC.

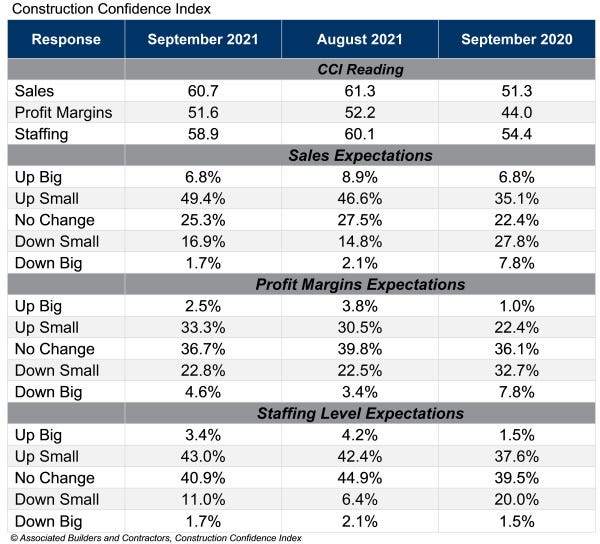

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels each declined in September, but remain above the threshold of 50, indicating expectations of growth over the next six months.

“Nonresidential construction backlog declined for a second consecutive month as skills and input shortages hammer the industry,” ABC Chief Economist Anirban Basu said. “A growing number of contractors are indicating shortages of materials such as copper and PVC pipes.

“Input prices also continue to increase as global supply chain disruptions persist,” Basu continued. “Rising shipping and trucking costs are further exacerbating the situation by placing additional upward pressure on input prices. Working in conjunction with skills shortages and attendant higher wages, rising input prices are resulting in lofty bids, inducing certain project owners to delay work and even cancel projects altogether in some instances.

“The good news is that demand for construction services remains elevated,” Basu added. “Many projects, whether those in health care, public education or data management, must move forward, and the data indicate that this is disproportionately benefiting larger contractors. For the most part, recent declines in backlog have been registered among smaller construction firms. Low interest rates and abundant liquidity have created the capacity for many investors to deploy substantial capital, and that helps support investment in real estate and construction projects.

“Despite all the challenges facing the nonresidential construction industry, contractors collectively expect sales, staffing and profit margins to expand over the next six months, though the level of confidence has been diminished in recent months,” Basu concluded.

You May Also Like