The majority of Roofing & Exteriors Power Players do some type of residential work, but what characteristics connect and separate these elite contractors—and what can you learn from them?

July 20, 2022

Sponsored by SRS Distribution

Residential roofing contractors comprise a robust segment of the industry, representing a $56 billion market that’s growing about 2% a year, according to IBIS World data. That massive market is reflected in the Roofing & Exteriors 2022 Power Players, where contractors who perform residential roofing make up the lion’s share of the list.

In fact, 60% of Power Players—30 out of 50—reported they do some type of residential roofing as part of their business. Annual revenue in this group ranged from a high of $202 million down to $1 million. In total, those contractors pulled in nearly $2 billion in annual revenue. But whether that revenue was in the hundreds of millions or tens of millions, these elite roofers share a common goal of continually learning and growing.

Corey Construction is a good example. With $202 million in annual revenue and a revenue split of 93% residential to 7% commercial, the company boasts the highest annual income among residential contractors—and is dedicated to growing even more.

“Corey Construction is very active in many peer industry and leadership groups. Many of our employees meet regularly with these groups, as it is highly encouraged in the company,” wrote Dana Broom, marketing director for Corey. “We believe it will build them up to succeed and help the company continue to grow.”

That growth-forward sentiment was also reflected in Mac Roofing & Construction Co. Inc., which was at the lower end of annual income at $1 million. “We never think we’ve ‘arrived.’ We are always striving to get better,” said MacDonald Sprague III, owner of Mac Roofing. “Our reputation more that confirms that. We will continue to attend seminars as well as other opportunities to learn and grow.” The company’s revenue split is 70% residential to 30% commercial.

Overall characteristics of Power Players residential contractors

As a whole, residential Power Player roofing contractors are a family affair, with nearly 60% indicating family business as their owner type. Tied for second at 10% each are sole proprietor and LLC. That family characteristic tends to color the whole of companies, and many emphasize the bonds that they create with employees. Although COVID-19 tested those bonds, even the larger companies found ways to maintain their togetherness.

“Malone has always had a strong culture of family and togetherness,” wrote Roman Malone, president of E. Cornell Malone Corp/Malone Roofing Services, a $61 million family business with 200 employees. “Since we were not able to gather in large crowds, last summer the executive members of our company held a fish fry event for each of our local divisions. This was able to allow the ownership to once again to meet with our local team members in person.”

Sole proprietorships also often boast strong family bonds with employees.

“Antis holds annual company picnics, summer barbeques and holiday celebrations for the team members. These events are catered, have live music—often times mariachis—and include games and raffle prizes for the staff as an appreciation for everyone’s hard work,” wrote Cori Vernam, director of marketing and cause for Antis Roofing and Waterproofing, a sole proprietorship with 95 employees and $15 million in annual sales. “These company events build camaraderie and allow all members of the team to get to know each other (office staff gets to mix and mingle with the field technicians). We even had a dunk tank at a BBQ where the Founder and other executives got dunked!”

Residential Power Players also tend toward longevity in the industry, with 56% boasting 20–40 years in business. Another 17% are even longer in the tooth, with 41–60 years or more in business, while 27% are relative upstarts, with zero to 10 years in business.

With more than 160 years in business, Henson Robinson Company boasts the longest history, which plays out in the community and among employees.

“We are dedicated to being No. 1 in Central Illinois, providing the best talent and the best customer service as well as giving back to the community,” wrote Sheila Norman, office manager for Henson Robinson, with 200 employees and $60 million in annual sales. “We are very much a family here. We have regular gatherings that help bond us together. Most everyone that works here has been here a very long time.”

Residential vs. commercial roofing and exteriors work

When it comes to a company’s business focus, it’s rare for Power Players to rely only on residential roofing. Only 27% of the residential Power Players said they focus solely on that market segment, while 73% said they focus on both commercial and residential work.

With 95% residential roofing business and $50 million in annual sales, RoofClaim.com is among the most residentially focused companies on the Power Players list. As such, the company’s digitally focused strategy offers lessons for all residential contractors, especially amid the pandemic.

“After COVID-19 came and changed the way everyone does business as we know it, it was important for us to be innovative on our approach of sharing information with current and potential consumers,” said Zena Matti, RoofClaim.com’s VP of sales and marketing.

Types of work for residentially focused Power Players

When it comes to the type of work residential contractors offer, it’s a given that renovation and repair/re-roofing top the charts. But about a quarter of residential roofers also do new construction and service.

Of course, service can take many forms. For most residential contractors, it boils down to providing top-notch customer service along with solid warranties.

Aspen Contracting, with $85 million in annual sales and 90% residential roofing business, is a good example.

“Aspen's motto is ‘Doing the Right Thing Through Higher Standards and Integrity,’” wrote Courtney Nussbeck, marketing and events manager for Aspen. “We stand behind that in everything we do. That's why we are dedicated to our customers 24/7.”

Niche markets are also important to this group of contractors, and several have made their name doing specialty work. For example, The Durable Slate Company, with $22 million in annual sales and 45% residential business, prides itself on its ability to restore old roofs.

“Historic roofing is an uncommon skill that requires mastery of durable but temperamental natural materials. Unlike general contractors, we focus exclusively on slate, tile, copper roofing and ornamentation,” wrote Gabi Criado, PR and marketing representation for Durable Slate. “Our craftsmen are trained by our in-house experts according to our own obsessive work and safety standards. As a result, our historic roofs are world-class, and our workers are safe no matter the roof type, size or height. These standards, codified into our company philosophy—The Durable Way—have helped us earn numerous awards and professional distinctions, including several NRCA Gold Circle Awards.”

Areas of business for residential Power Players

While roofing represents the largest area of business for Power Players, it’s by far not the only one.

In fact, 21% of residential roofers also offer siding services, while 10% offer window replacement. A handful provide some form of gutter replacement or gutter guards. This home exteriors one-stop-shopping advantage is the recipe firms have used to grow their market.

With $185 million in annual sales and 70% residential business, firms like Feazel are a good example. Along with roofing, the company offers siding repair and replacement, window replacement, gutters and gutter guards along with solar.

“Feazel is a dedicated home remodeler that has offered a range of services to customers across multiple states since 1988,” Feazel says on its website. “Our team also provides a full range of home exterior renovations for customers.”

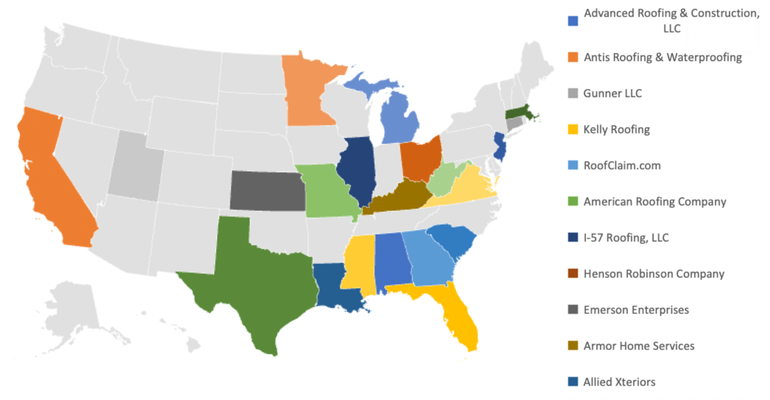

Geographic reach of roofing and exteriors Power Players

Residential contractors span the U.S. from coast to coast. While they are concentrated in the southeast part of the country, the Midwest is well represented, too.

With three contractors hailing from Texas—Corey, CMR Construction & Roofing and Umbrella Tech Inc.— the Lone Star State ties with Ohio—which houses Feazel, NextGen Restoration and Durable Slate—for the most contractors among residential Power Players.

Coming up right behind are Georgia (RoofClaim.com and American Roofing Company), Illinois (Henson Robinson and I-57 Roofing), Minnesota (Renner Roofing and Merit Contracting), Mississippi (Complete Exteriors and E. Cornell Malone Corp/Malone Roofing Services), and Virginia (Cross Timbers Roofing and The Pinnacle Group)—each with two companies represented.

But no matter where they are, big or small, the one thing that binds our 2022 Power Player residential contractors together is a commitment to the industry that goes beyond geographic bounds.

If you missed featured Power Players from previous weeks, use these links to view Week 1, Week 2, Week 3, Week 4 and the full list.

Read more about:

Power PlayersAbout the Author(s)

You May Also Like