Construction equipment pricing continued to climb in February, with average fair market value up 5.1% year over year. Resale activity declined as construction firms continue to hold onto equipment longer.

April 14, 2022

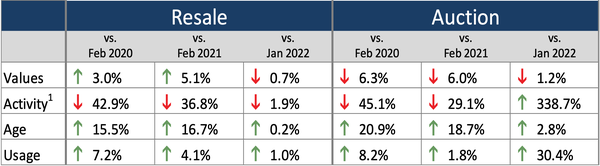

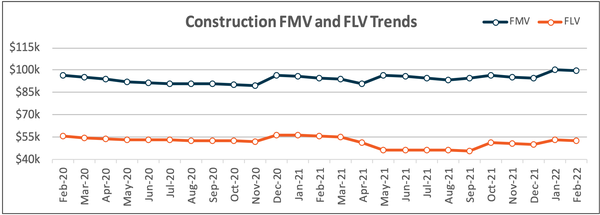

Construction equipment pricing continued to trend upward in February 2022. Average FMV was up 5.1% compared to February 2021 and 3.0% compared to February 2020. Construction firms are still holding on to equipment longer, and activity is down significantly compared to previous years. Resale activity was down 36.8% compared to February 2021 and 42.9% compared to February 2020. However, it was only down 1.9% compared to January 2022.

(Resale activity based on listings; Auction activity based on sales results.)

Economists predicted that construction activity would be high in 2022. State and local governments are still using funds from the American Rescue Plan, and projects funded by the historic Infrastructure Investment and Jobs Act (IIJA) are expected to break ground later in the year. This slight uptick in resale activity may be a reflection of the fact that firms are seeing increased activity and ramping up for the disbursement of IIJA funds.

Buyers have an older selection of models to choose from. The average age of equipment is up 16.7% compared to February 2021, and 15.5% compared to February 2020.

On the auction channel, average FLV was down 6.0% compared to the same period in 2021. This is a slight increase from January 2022, when average FLV was down by 5.8%. Auction activity spiked significantly—up 338.7% over January 2022 levels. But it’s still down by 29.1% compared to February 2021, and 45.1% compared to February 2020. This is a continuation of typical seasonality, which may extend into next month.

The age of the equipment available on the auction channel ticked up by 18.7% compared to February 2021, and 2.8% compared to January 2022. Usage rates are up slightly (1.8%) compared to February 2021, but they jumped significantly compared to January levels—30.4%.

2015, 2014, and 2016 models were the most popular model years sold, accounting for 14.7%, 13.8%, and 11.4% of the market respectively. Skid steer loaders, crawler mounted compact excavators, and compact track loaders were the most popular types of equipment sold in the auction channel.

*Fair Market Value (FMV) is the value of an asset sold to a single buyer under no compulsion. Forced Liquidation Value (FLV) is the value of an asset sold at a properly advertised and conducted auction in which the seller is under compulsion to sell on an as-is, where-is basis as of a specific date.

This article is brought to you through a collaboration between EquipmentWatch and World of Concrete 360. The EquipmentWatch Market Report is a monthly resource for the construction, lift/access, and agriculture industries to help equipment managers make better-informed decisions by leveraging key equipment values, market activity, age, and usage metrics. For more information about EquipmentWatch’s methodology and data, and to learn more about what it has to offer contractors, click here.

About the Author(s)

You May Also Like