Construction Equipment Price Trends for January 2022

Construction equipment resale and auction values in December were down month to month and year-over-year. There were two notable changes between December 2020 and December 2021 around the most prevalent equipment types on the resale channel.

February 11, 2022

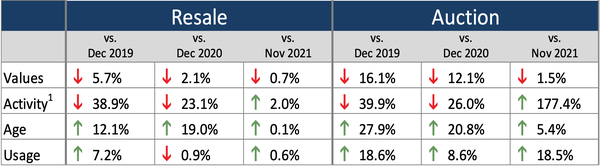

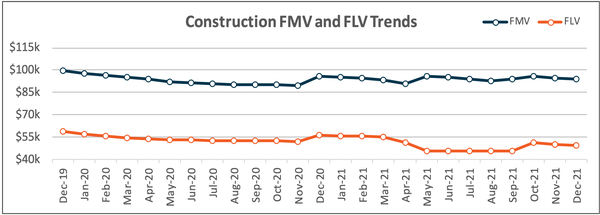

Throughout 2021, there were notable price and activity changes impacted by the supply of equipment. Average FMV ended 2021 2.1% below December 2020 and 5.7% below December 2019, right before the shutdowns began. The auction channel did not fare as well, down 12.1% from December 2020 and 16.1% from December 2019. The activity on the auction channel is beginning to rebound, up 177.4% from November, but remains 26% below where it was in December 2020.

(Resale activity based on listings; Auction activity based on sales results.)

There were two notable changes between December 2020 and December 2021 around the most prevalent equipment types on the resale channel. In 2020, crawler-mounted compact excavators and tractor-loader-backhoes took up 6.7% and 6.3% of the resale channel activity. In 2021, the articulated rear dumps increased to a 6.3% market share and standard crawler dozers were up to 6.0%.

The type of equipment dominating the market was not the only large shift between years. In December 2021, the most prevalent model year on the resale channel was 2018 followed by 2019 at 10.8% and 10.3%. This is not a large difference from December 2020 as the 2017 and 2018’s were at 10.2% and 9,9% of the resale channel activity. Where the difference is showing is less equipment available around the 4–6-year-old mark. The equipment for sale on the resale channel at the end of 2020 between ages 4 and 6 made up 40.5% of activity, but at the end of 2021 the same aged equipment was only 27.2% of activity.

Diving into the auction channel’s performance in December 2021, the average FLVs were down 1.5% month-over-month and 12.1% year-over-year. Overall auction volume was up significantly from November at 177.4%. While this is typical in December as the year comes to an end, it was an even larger increase than the same months of 2020. Just like on the resale channel, the average age increased again in December ending 20.8% over December 2020. To go along with the average age and activity increases, average meter reads were up for construction equipment at auction 18.5% over November.

Despite age increases, nothing was shocking about the model year market share on auction. The same top 5 model years were showing up in December 2021 auction sales as were during December 2020.

*Fair Market Value (FMV) is the value of an asset sold to a single buyer under no compulsion. Forced Liquidation Value (FLV) is the value of an asset sold at a properly advertised and conducted auction in which the seller is under compulsion to sell on an as-is, where-is basis as of a specific date.

This article is brought to you through a collaboration between EquipmentWatch and World of Concrete 360. The EquipmentWatch Market Report is a monthly resource for the construction, lift/access, and agriculture industries to help equipment managers make better-informed decisions by leveraging key equipment values, market activity, age, and usage metrics. For more information about EquipmentWatch’s methodology and data, and to learn more about what it has to offer contractors, click here.

About the Author(s)

You May Also Like