Construction equipment resale and auction values in January reflect the challenges posed by increased demand and reduced production levels, including a dramatic decrease in resale activity as construction firms hold on to equipment longer.

March 10, 2022

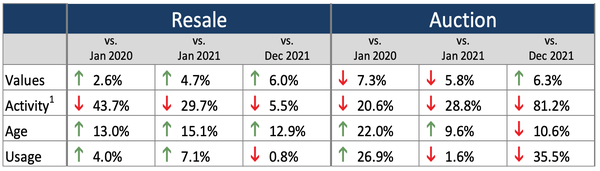

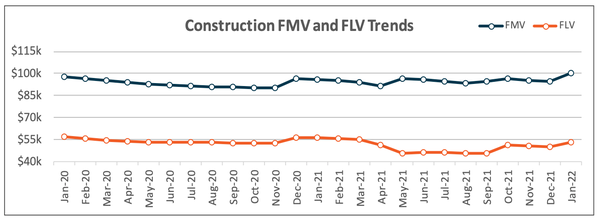

2022 started with continued price and activity fluctuations driven by production slowdowns and a rebound in construction activity. At the end of January, average FMV was up 4.7% compared to January 2021, and 2.6% compared to January 2020.

(Resale activity based on listings; Auction activity based on sales results.)

Because of high prices and a severe shortage of new equipment, many construction firms are holding on to equipment longer. Resale activity is down dramatically—43.7% below January 2020, 29.7% below January 2021 levels, and 5.5% below December 2021.

2018 and 2019 models account for the largest share of the resale market, as 10.7% and 10.3% respectively. The availability of 5- to 7-year-old models continues to be low, accounting for only 26.5% of the market. It’s not just that individual firms are holding on to their equipment longer. Rental companies, which typically refresh equipment after 3.5- to 4-year cycles, are seeing such high utilization rates that they can’t sell their assets off like they normally would. That means large fleets aren’t being placed on the resale market, constraining supply even further.

Shifting to the auction channel, average FLV is down 5.8% compared to January 2021, and activity is down 28.8%. This reflects typical seasonality, and we expect fluctuations to continue for the next two months.

Compared to December 2021, there were a couple of notable shifts in the types of equipment being auctioned. Skid steer loaders jumped from the fourth most prevalent equipment subtype to being the first, accounting for 11.9% of market share. And 4-WD articulated wheel loaders accounted for 6.7% of auction sales, down from 10.5% in December 2021.

*Fair Market Value (FMV) is the value of an asset sold to a single buyer under no compulsion. Forced Liquidation Value (FLV) is the value of an asset sold at a properly advertised and conducted auction in which the seller is under compulsion to sell on an as-is, where-is basis as of a specific date.

This article is brought to you through a collaboration between EquipmentWatch and World of Concrete 360. The EquipmentWatch Market Report is a monthly resource for the construction, lift/access, and agriculture industries to help equipment managers make better-informed decisions by leveraging key equipment values, market activity, age, and usage metrics. For more information about EquipmentWatch’s methodology and data, and to learn more about what it has to offer contractors, click here.

About the Author(s)

You May Also Like